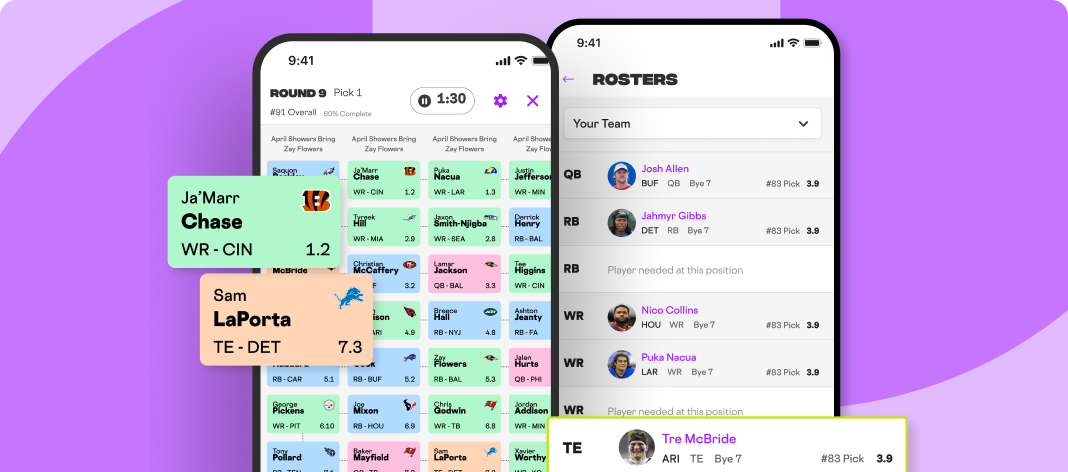

From a fantasy perspective, it's hard to think of a recent season that looked more exciting than 2024 in the lead up to Week 1. Eight of the first 10 picks in this year's NFL Draft were either QBs or WRs, and that's on top of a 2023 class that produced some of the best rookie seasons ever at quarterback (C.J. Stroud), wide receiver (Puka Nacua) and tight end (Sam LaPorta).

The likelihood of competent QB play in Atlanta and New York adds another layer of intrigue, setting up potential breakout campaigns for A+ talents Drake London, Kyle Pitts, Bijan Robinson, Garrett Wilson and Breece Hall. There's also no shortage of topics for fantasy players to argue about, be it unlikely breakout stars from last season like Nacua and Kyren Williams, or projected target distributions for Big 3 WR groups in Houston and Chicago. Dolphins RB De'Von Achane may be the most divisive player of all — with apologies to Nacua and Williams — following a rookie campaign in which 103 carries and 37 targets somehow yielded 800 rushing yards and 11 total TDs.

For all that excitement, it's impossible to discuss the upcoming season from a bird's eye view without mentioning that 2022 and 2023 were unusually low-scoring years by modern standards. Teams averaged 21.8 points per game last year and 21.9 the year before, following a four-year stretch in which the number was at least 22.8 each season. 2017 was also a low-scoring year at 21.7 ppg, but prior to that were five consecutive seasons at 22.6 or higher from 2012 to 2016.

The layman's explanation for the scoring downturn focuses on the increased popularity of two-high defenses, whereby both safeties are far away from the line of scrimmage and have deep-coverage responsibilities on their respective halves of the field. That's reasonable enough as a partial explanation, but it's unlikely that cratering NFL scoring was as simple as using already-popular coverages more often.

Below I'll discuss some of the additional explanations, and then I'll take a look at other trends around the league that matter for fantasy football. Much of this will be looking backward rather than forward, but I'll also touch on my expectations for 2024 and beyond.

Coverage Schemes

League-Wide Coverage Schemes by Season

| Year | Single-High | Two-Deep | Man | Zone | Cover 1 | Cover 2 | Cover 3 | Cover 4 | Cover 6 |

|---|---|---|---|---|---|---|---|---|---|

| 2023 | 53.4% | 42.1% | 28.4% | 71.6% | 22.2% | 12.7% | 31.1% | 17.5% | 9.8% |

| 2022 | 55.0% | 40.9% | 29.1% | 70.9% | 23.2% | 13.9% | 31.8% | 15.9% | 8.7% |

| 2021 | 56.5% | 38.9% | 30.6% | 69.4% | 24.0% | 13.6% | 32.5% | 14.4% | 8.5% |

| 2020 | 59.2% | 35.9% | 34.6% | 65.4% | 27.5% | 13.0% | 31.7% | 13.2% | 7.1% |

| 2019 | 60.2% | 35.3% | 37.3% | 62.7% | 30.4% | 13.3% | 29.8% | 12.5% | 6.7% |

| 2018 | 62.6% | 33.7% | 35.3% | 64.7% | 28.9% | 12.6% | 33.6% | 11.3% | 6.7% |

Data confirms an upward trend in use of two-deep defenses and zone coverage in general, with Cover 1 becoming considerably less popular while Cover 4 (quarters) and Cover 6 (blend of Cover 2 and quarters) have been used more frequently. The extent of those changes is smaller than the relevant discourse suggests, but there's enough there for it to have a meaningful impact on offensive strategy and efficiency.

Now let's look at some key QB stats against single-high (SH) and two-high (2H) coverages:

Single High (SH) vs. Two High (2H)

| SH Comp% | SH YPA | SH AYA | SH Sack% | SH INT% | 2H Comp | 2H YPA | 2H AYA | 2H Sack | 2H INT% | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2023 | 62.50% | 7.2 | 8.3 | 6.9% | 2.28% | 67.8% | 7.0 | 7.4 | 6.7% | 2.56% |

| 2022 | 63.40% | 7.4 | 8.2 | 6.7% | 2.06% | 66.6% | 6.9 | 7.5 | 5.9% | 2.56% |

| 2021 | 63.30% | 7.3 | 8.2 | 6.3% | 2.26% | 68.3% | 7.2 | 7.4 | 5.7% | 2.56% |

| 2020 | 64.60% | 7.4 | 8.3 | 6.1% | 2.00% | 66.9% | 7.3 | 8.0 | 4.9% | 2.40% |

| 2019 | 62.60% | 7.4 | 8.5 | 6.3% | 2.22% | 66.5% | 7.2 | 7.8 | 6.7% | 2.36% |

We essentially see three very strong trends and one weaker trend.

1) QBs complete a lower rate of passes against single-high coverages.

2) QBs average more yards per completion AND per attempt against single-high coverages.

3) QBs throw interceptions at a much lower rate against single-high coverages.

4) QBs take more sacks against single-high coverages (weaker trend).

The jarring part here is that QBs threw 6-24 percent more INTs per pass attempt against two-high coverages every year, even though they were generally attempting shorter, higher-percentage passes against those coverages. The superior completion percentage doesn't even come close to making up for the losses in terms of yardage and INTs.

Another surprising thing you might notice above is that two-high coverages have become more effective as teams have used them more often (opponent AY/A was actually reasonably good against SH in 2019 and 2020, though it was better against 2H). We might expect the opposite, but it makes a little more sense when looking deeper into the data and considering that some coverages look like one thing pre-snap and end up being another.

I'd even wager that schematic improvements on the defensive side are mostly a product of disguising intentions and using higher-complexity coverage schemes, not simply a matter of keeping two safeties deep more often. This is harder to prove, and there is some synchronicity because it's easier to hide intentions and play a variety of different schemes pre-snap if you don't have a safety in the box. Pulling a safety up toward the line of scrimmage obviously helps defend the run, but it also gives the QB a lot of information about what he might see post-snap if it's a pass play.

And while the evidence for increased complexity of defensive schemes is mostly anecdotal, we can at least see a degree of statistical basis by looking at the popularity and efficacy of coverages that shift from two-high before the snap to single-high after the snap (or vice versa). Below you'll see a table that shows four general coverage schemes and the EPA per dropback that QBs posted against them each season, with the number of dropbacks that faced said scheme each season in parentheses.

First you'll see "SH>SH," which is defenses that showed a single-high look before the snap and stayed in it. Then we have "2H>2H," which is the same thing but for two-high coverages. After that is the interesting point, showing defenses that shifted their look after the snap, either from single-high to two-high (SH>2H) or the other way around (2H>SH).

Coverage Schemes by EPA/DB (# of Dropbacks in Parentheses)

| SH>SH | 2H>2H | SH>2H | 2H>SH | |

|---|---|---|---|---|

| 2023 | -0.04 (6,408) | -0.06 (7,223) | -0.02 (1,413) | -0.11 (4,549) |

| 2022 | 0.04 (6,717) | -0.03 (6,915) | 0.03 (1,305) | -0.05 (4,338) |

| 2021 | 0.05 (7,465) | 0.01 (6,495) | 0.01 (1,535) | -0.07 (4,173) |

| 2020 | 0.08 (8,059) | 0.07 (5,504) | 0.04 (1,513) | -0.03 (3,580) |

| 2019 | 0.03 (8,446) | -0.02 (5,402) | 0.08 (1,396) | -0.02 (3,209) |

| 2018 | 0.09 (8,776) | 0.10 (4,980) | 0.01 (1,319) | 0.02 (3,123) |

The table shows some trends we've already discussed, namely the increasing popularity of two-high coverages overall. What's even more interesting is that the two-high looks shifting to single-high coverages (final column) have not only increased in popularity but also been the most effective coverages out of the four buckets above ... and have actually been more effective as the usage has increased.

We also see that coverages shifting from single-high to two-high aren't that common, nor are they especially effective. In Madden, it's easy to stack the box and have the box safety drop into a deep coverage anyway. In real life, that's a lot more difficult, and it's generally easier to come forward for a shallow zone from a deep position, seeing what's in front of you rather than running away from the QB with your back turned.

There are all kinds of ways to disguise coverages, of course; it's not limited to shifting the depth of the safeties to make Cover 3 look like Cover 2 or vice versa. NFL coaches have even mentioned that it's increasingly common for defenses to use dynamic coverages that can change after the snap based on route combinations, i.e., "if this, then that." This is probably part of what's giving QBs trouble, perhaps compounded by a rough two-year run of injuries at the position.

It's basically the defensive equivalent of option routes, whereby a pass catcher reads the coverage to determine what he should do. Once considered a rarity or newfangled addition to the pro game, option routes are now a huge part of every NFL offense. Defenses are fighting back with increased use of schemes that look like one thing before morphing into another, which can confuse not only the quarterback but also any receivers that have to make on-the-fly decisions.

The downside of these dynamic coverages is that the reliance on snap decisions by defenders means the wrong choice can leave a receiver open for a huge gain. As NFL offenses become more accustomed to facing these schemes, they'll likely get better at deploying route combinations and/or pump fakes that trick defenders into making the wrong choice and leave a guy wide open downfield. That's certainly happened some already, but it mostly seems that QBs and playcallers have been too quick to settle for the short, easy completions that these zone coverages offer, i.e., they're throwing the pass the defense wants them to throw.

Beating up on complex defensive coverages may require QBs and playcallers to eschew the long-term offensive trends favoring high-percentage, short passes that rely on YAC (rather than higher-variance throws downfield). In some cases this might mean questioning fundamental principles and concepts that have been ingrained for decades. After all, the trend toward higher completion percentages and less yards per completion dates back to the 1970s and has kept on moving in the same direction for 45 years now (albeit with some stops and starts, inflections, etc.).

Special Teams / Fourth Down

The NFL studied the scoring downturn, and one of its conclusions was that superior punting has been a surprisingly big part of the equation. That said, field-goal kickers are more accurate than ever before, and we've also seen more fourth-down tries in lieu of punts (a.k.a. an over bettor's best friend).

The NFL dug into the data to try to understand why scoring dropped over the last two seasons (45.6 ppg in 2012-21, excl. '20 vs. 43.7 ppg in 2022-23).

Some reasons they found:

Pace of play (-0.9 PPG): shorter passes, longer drives -> one fewer drive per team

More backup QBs…

— Nicki Jhabvala (@NickiJhabvala) February 29, 2024

What's more, the league is introducing a new kickoff setup that will boost average starting field position after kickoffs by 3-5 yards. Between this major change and the impressive accuracy of modern kickers, it looks like any point-suppression gains from improved punting are being fully canceled out (and then some?).

According to the NFL, the kickoff return rate through 2 preseason games is at 78%. Last year, it was 22%.

The average starting field position has been just past the 28-yard line. In '23, it was just shy of the 24-yard line.

It's early, but the kickoff rule has made an impact.

— Tashan Reed (@tashanreed) August 19, 2024

In fantasy terms, the special teams stuff isn't all that important unless you're in a return yardage league, as it mostly impacts teams in the same way (or at least in a manner that's highly difficult to predict ahead of time). The fourth-down trends are somewhat more interesting for our purposes, impacting projections for field goals vs. touchdowns.

The Lions, for example, have one of the best offenses in the league and play in a dome, but their kicker (Jake Bates, probably) isn't necessarily a top fantasy play, because coach Dan Campbell prefers going for it on fourth down in borderline situations. The Chiefs, on the other hand, have a coach who leans toward taking the three points, which helps Harrison Butker get solid field-goal volume even though Patrick Mahomes and Co. tend to be efficient in the red zone.

Just keep in mind that coaches aren't always steady on these things from year to year. There was a lot of discussion back in 2019 about the Ravens frequently going for it (and the associated analytics), but in 2023 coach John Harbaugh finished 31st in Football Outsiders' measure of fourth-down aggression.

Harbaugh went for it a lot in 2019 and 2020 but hasn't been so gung-ho in subsequent years (which is probably ill-advised given that the Ravens have a dual-threat QB and generally efficient offense). He's pretty good at not messing up the situations where punting/kicking is hugely disadvantageous in terms of win expectancy, but he rarely goes for it in the borderline situations anymore.

League-Wide Fourth-Down Attempts by Season

| 4D Att | Conversion Rate | |

|---|---|---|

| 2023 | 799 | 51.6% |

| 2022 | 736 | 50.7% |

| 2021 | 793 | 53.1% |

| 2020 | 658 | 55.0% |

| 2019 | 595 | 47.9% |

| 2018 | 539 | 55.7% |

| 2017 | 485 | 46.0% |

Campbell and Philadelphia's Nick Sirianni probably have the strongest multi-year track records of choosing fourth-down attempts over field goals and punts. Green Bay's Matt LaFleur, Cleveland's Kevin Stefanski and Miami's Mike McDaniel aren't far behind, and Arizona's Jonathan Gannon was No. 1 for the FTN/FO fourth-down aggression metric in his 2023 debut campaign.

Coaches with defensive backgrounds unsurprisingly tend to favor FGs and punts over fourth-down tries, but it looks like Gannon may be an exception. One of the biggest surprises for a lot of people is that Rams coach Sean McVay routinely lands near the bottom of fourth-down-aggression measures. He's perhaps similar to Harbaugh in that he's pretty good at avoiding huge strategic mistakes but almost never goes for it if there's a decent argument not to.

The list of coaches who tend to be cautious to a fault is highlighted by Pittsburgh's Mike Tomlin, New Orleans' Dennis Allen, Indy's Shane Steichen and New York's Brian Daboll. The reality of Pittsburgh's strengths/weaknesses suggest a more conservative approach makes sense, but even within that context Tomlin goes too far. Tomlin is perhaps over-adjusting to his personnel, whereas Reid isn't adjusting to it enough (an elite offense like KC's should be decent at converting fourth downs even if it's more of a finesse operation ... which should in turn encourage a coach to go for it more often).

Steichen is one to watch this season, as it's possible his approach changes drastically if Anthony Richardson is the dual-threat and short-yardage monster many expect him to be. Such a development would make it all but impossible for Matt Gay to match last year's total of 41 field-goal attempts (second most in the league) even if the Colts reach scoring range more often.

QB Woes Winding Down?

Reduced quality of QB play is probably a big part of the explanation for reduced scoring in recent years, but not in an Old Men Yells At Cloud type of way where I yearn for the Mannings and Bradys of yesteryear. An unusual number of injuries to high-quality QBs the last two years was a major factor, and there may have also been a temporary drop off in talent at the position when a slew of long-time starters left the league (and/or became terrible) within the span of a few years.

Even if they weren't at their best by the end, it's hard to make up for losing Philip Rivers, Tom Brady, Drew Brees, Matt Ryan, Ben Roethlisberger within a span of 2-3 seasons. Those five are in the top seven for career passing yards, and they retired at around the same time that some lesser players (Cam Newton, Joe Flacco, Andy Dalton) aged out of being starter-quality QBs.

It didn't help that the 2021 NFL Draft brought a quartet of first-round busts and the 2022 Draft provided nobody competent besides Brock Purdy. We basically got two legitimate starting QBs (Purdy, Trevor Lawrence) out of the 2021 and 2022 Drafts, whereas seven guys from those classes have played a bunch and proven to be anywhere from subpar to downright embarassing (Zach Wilson, Justin Fields, Mac Jones, Davis Mills, Kenny Pickett, Desmond Ridder, Sam Howell).

The last two drafts appear much better, giving us one superstar already (C.J. Stroud) and a bunch of others with ample potential (Anthony Richardson, Caleb Williams, Jayden Daniels, Drake Maye, Michael Penix, J.J. McCarthy, Bo Nix). Even Bryce Young and Will Levis aren't necessarily lost causes, and if one of them turns into a half-decent starter it will automatically make the 2023 QB class the best since 2020 (although the 2024 group may then quickly surpass it).

The influx of young talent combined with the likelihood of better injury luck should help scoring bounce back some in 2024 even if other factors continue to trend in favor of defenses. It also means we have a lot of interesting options at almost every stage fantasy drafts, be it early picks like Josh Allen, Jalen Hurts and Lamar Jackson who can dominate with rushing stats, elite passers like Patrick Mahomes and Stroud with 40-TD potential, or later picks like Jayden Daniels, Caleb Williams and Trevor Lawrence who are about as talented as some of the early round guys and just need more refinement, support and/or luck.

Alpha WR1 Production Surges

Scoring and passing efficiency may have declined considerably the past couple years, but top-notch pass catchers didn't suffer. Eleven receivers averaged 80 receiving yards per game last year, including three above the century mark. In 2021, a much higher-scoring season, there were just six players that reached 80 ypg and only Cooper Kupp at 100.

Number of Pass Catchers Reaching Milestones (Yards per Game)

| 50+ | 60+ | 70+ | 80+ | 90+ | 100+ | |

|---|---|---|---|---|---|---|

| 2023 | 48 | 30 | 16 | 11 | 5 | 3 |

| 2022 | 43 | 26 | 16 | 7 | 3 | 2 |

| 2021 | 46 | 31 | 15 | 6 | 3 | 1 |

| 2020 | 54 | 31 | 20 | 9 | 4 | 0 |

| 2019 | 56 | 39 | 22 | 5 | 3 | 1 |

| 2018 | 46 | 30 | 23 | 13 | 6 | 1 |

| 2017 | 42 | 25 | 9 | 4 | 3 | 1 |

| 2016 | 57 | 34 | 13 | 6 | 3 | 1 |

Ben Gretch did a much more comprehensive study of this trend on his Stealing Signals substack, finding that 2023 featured the highest concentration of production going to teams' No. 1 receiving weapons (31.5 percent) since 2015. The number was right around 30 percent in 2021 and 2022, which was much higher than in 2020 (28.3 percent) but in line with long-term averages.

As you may have noticed, I tend to favor talent explanations as much or more than schematic ones, and this is probably another case where the explanation contains a little bit of both. There's an impressive collection of elite WR talent around the league right now, led by superstars in their mid-20s like Justin Jefferson, Ja'Marr Chase, CeeDee Lamb and A.J. Brown. You'd have to go all the way back to 2018 to find the last truly subpar WR draft, and that was the final year of a four-year stretch that featured a high rate of early round busts but also a bunch of massive success stories from Round 3 and later (Stefon Diggs, Tyreek Hill, Cooper Kupp, Chris Godwin, Kenny Golladay).

All of those mid/late-round stars besides Golladay are still going strong, and we then saw five consecutive drafts (2019-23) ranging from above average to excellent in producing high-quality receivers. Now we've got an incoming class with three top-10 picks and seven first-rounders, with mega prospects Marvin Harrison, Malik Nabers and Rome Odunze all but ensuring it will be a decent class for the position even if there aren't many success stories beyond the first round.

That being said, there are also some schematic explanations for the increasingly concentrated receiving production, including the popularity of run-pass options (RPOs) in recent years. Rather than choosing between four or five eligible receivers like they would on a normal pass play, quarterbacks executing RPOs can either hand the ball off or throw to one or two different receivers. The pass plays from RPOs produce a lot of slants and screens for top receivers, while a team's ancillary pass catchers will tend to be blocking or running clear-out routes that aren't part of the QB's read.

Eleven players last season accounted for more than 30 percent of their team's RPO targets, and 12 others were at 25 percent or higher. Michael Pittman drew a league-high 43 targets on RPOs, accounting for 45.7 percent of the Colts' total (and all four of his receiving TDs). Tyreek Hill was second with 40 such targets, getting 39.6 percent of Miami's total even though he missed a game and a half. Zay Flowers got 28, which was 32.6 percent of the Baltimore total. CeeDee Lamb drew 25, or 31.3 percent of the Dallas total.

One notable exception was Philadelphia, where A.J. Brown, DeVonta Smith and Dallas Goedert each landed in the 20-23 percent range ... one year after AJB led the league with 43 RPO targets (34.7 percent team share). The Eagles have long been at/near the top of the league in RPO usage, but they averaged just 4.34 yards on 10.5 RPO snaps per game last year, down from 7.51 yards on 11.4 RPO snaps per game in 2022, or 6.17 yards on 17.6 RPO snaps per game in 2023.

There are two other schematic trends that favor more targets going to teams' No. 1 options. The first is increased frequency of screens and other snap-passes to wide receivers, beyond even what's provided via RPOs. The percentage of passes that were WR screens rose in each of the past four seasons, going from 5.2 in 2019 and 5.5 percent in 2020 all the way up to 6.8 percent in 2022 and and 7.2 percent in 2023. Anecdotally, we saw the Chiefs have a lot of success last season throwing quick passes to Rashee Rice where the target essentially was determined pre-snap.

Now, to be fair, talent may also be part of the equation, as the current group of elite WRs seem to be unusually good after the catch (led by Deebo Samuel, A.J. Brown, Amon-Ra St. Brown, CeeDee Lamb and Ja'Marr Chase). That's where we get into a chicken-or-the-egg argument, i.e., Are these WRs better suited for the modern game, or are there skill sets changing the way teams play offense? It may be some of both, of course.

The second schematic trend favoring target concentration is less likely to be related to the players themselves and more likely to be a product of coaching and analytics. You've probably heard something about pre-snap motion and how better offenses tend to use it more and how most teams are more efficient when they move at least one player before the snap. The biggest advantage comes from having a guy still in motion when the ball is snapped, with Miami's so-called cheat motion — quickly copied by other teams — getting a lot of attention last year.

Final motion report for the 2023 season!

In 2017 NFL teams put a man in motion at the snap 4% of the time, on average. In 2023 the average was 22%!

Data via @ESPNStatsInfo video tracking team. pic.twitter.com/Ar67rJ9yWE

— Seth Walder (@SethWalder) January 16, 2024

The use of pre-snap motion has been rising for years, and it's also been used more and more as a pass-game advantage to get players open, rather than for blocking purposes or simply giving the QB hints about man vs. zone coverage. Over the past couple years, it's often been the best receivers going in motion the most often, and they tend to be targeted at a higher rate on their in-motion snaps compared to their target rate overall.

Why do increasing pre-snap motion rates matter? These plays are correlated with increased WR efficiency, on both yards per route run (YPRR) and targets per route run (TPRR)

Here, at-snap motion is defined as a subset of pre-snap motion where WRs are in motion at the snap pic.twitter.com/H2jSiieLku

— Sam Sherman (@Sherman_FFB) July 25, 2024

Running Back Resurgence?

The first round of a typical 2024 fantasy draft reflects a WR-dominated era, both in terms of talent around the league and some of the schematic trends mentioned above. It's also the continuation of a longer-term development — one with roots in the NFL's shifts toward fewer running plays and more backfields-by committee throughout the 2000s and 2010s. This strategic change was aided, or perhaps even inspired, by increased enforcement and new interpretations of various defensive penalties, including roughing the passer, illegal contact and unnecessary roughness.

The NFL increased incentives to call pass plays rather than runs, and it did so at a time when some of the learning from baseball's sabermetrics revolution were starting to spread to other sports and inspire (some) decision-makers to think more in terms of numbers and less in terms of Xs and Os. In basketball, this meant more three-pointers and fewer mid-range jumpers. In hockey, it meant pulling goalies earlier and dumping the puck less often. In football, it meant more pass plays on first and second down (and eventually more fourth-down tries).

In addition to reducing the number of rush attempts, these changes led to additional playing time for specialized RBs that weren't especially good at running and instead thrived as pass catchers or blockers. Talented runners that might've gotten 20 carries and three targets per game in the NFL of old were instead averaging 15 carries and two targets while playing less than two-thirds of their team's snaps.

The silver lining in terms of fantasy value was the emergence of another breed of back that could put up standout production without huge rushing workloads, instead relying on receptions and outstanding per-touch efficiency. The 2017 rookie class was particularly fruitful for this type of player, featuring Christian McCaffrey, Alvin Kamara, Austin Ekeler and Aaron Jones, along with some guys that looked like traditional bruisers but could also catch passes when called upon (Dalvin Cook, Joe Mixon, James Conner, Leonard Fournette).

An incredible draft class stemmed the tide of RB fantasy decline and helped push positional target share upward. From 2010 to 2016, running backs accounted for between 18.1 percent and 20.1 percent of league-wide targets each season. In 2017, the number rose to 21.6 percent. In 2018, it was 21.1 percent. In 2019, it was 20.6 percent.

We've since seen RB target share drop back to its pre-2017 range, sitting at 19.5 percent or less each of the past four seasons. On top of that, RBs get a smaller share of the cumulative rushing attempts and rushing production than ever before, mostly because of the increase in dual-threat starting QBs like Lamar Jackson and Josh Allen (with the rise in WR rushing involvement a surprisingly strong secondary factor).

From 2017 to 2019, we saw additional RB targets offsetting the impact from some of these long-term trends. From 2018 to 2022, we saw RBs average 4.3 or 4.4 yards per carry each year, which also helped offset the lower number of carries (and increase in committee backfield usage) compared to the good 'ol days. Last year, there was no silver lining. RBs averaged just 4.1 YPC, back down in the 2013-17 range, and they didn't get more targets to make up for it. An average of 89.3 rushing yards per team game from RBs was the lowest number in modern history, and 32.4 receiving yards per game was the worst since 2012.

Actually, there was a silver lining ... if you happened to have Christian McCaffrey, Kyren Williams, and/or Raheem Mostert on your fantasy team. An environment with so few RBs putting up big numbers meant the exceptions to the rule were more valuable than WRs that put up similar fantasy totals.

McCaffrey already has two seasons (2019, 2023) in which he cleared the field at his position by more than 100 PPR points. In 2020, there were three RBs that topped 330 ... but no others above 265. In 2021, there was a 28-point gap between RB1 (Jonathan Taylor) and RB2 (Austin Ekeler), and then a 48-point gap between Ekeler and RB3 (Najee Harris). In 2022, the drop-offs weren't quite as harsh due to huge rushing seasons from Nick Chubb, Derrick Henry and Josh Jacobs, but there were still only six RBs that scored 250 PPR points.

Whether you pick 200, 250 or 300 PPR points as your milestone, it's probably now an unavoidable reality that more WRs than RBs will reach the number every year. Zero RB builds are more popular than ever, and perhaps rightly so, but it's also fair to say that this environment means a 350-point season from Bijan Robinson or Breece Hall would be more valuable than the same point total coming from Ja'Marr Chase or CeeDee Lamb. And while the RB spot tends to produce more early/mid-round busts and also more unexpected late-round/undrafted heroes, it's still the guys drafted at the very top that have the best odds (by far) to be among the few true difference-makers at the position.

Personally, I think the new equilibrium is better than the old, especially given the likelihood that both overall scoring and RBs' share of the fantasy scoring experience bounce backs this coming year. Positional scarcity at RB remains one of the dominant factors in nearly any fantasy draft, and yet we no longer see talented-but-ultimately-forgettable backs like Michael Turner being drafted ahead of Hall of Fame wide receivers in their prime.

The RBs that contend with HOF WRs for first-round fantasy status nowadays are either Hall of Famers themselves, like McCaffrey, or mega prospects like Hall and Robinson. That's a good thing, the way I see it, and we might even see a moderate shift back toward the RBs over the next few seasons if Hall and Robinson become superstars and/or the 2025 draft class (Ollie Gordon, Quinshon Judkins, Asthon Jeanty, etc.) lives up to its considerable hype.

Depth at Tight End (Finally)

In terms of catches/yards/TDs per game, league-wide production for TEs peaked in the mid-2010s and then decreased along with the rest of the offensive stats the past three years. Last season, the position accounted for 174 receiving TDs, a drop of 24 from the previous year and the lowest total since at least 2009. Lions rookie Sam LaPorta was the only TE with more than six scores.

Tight ends caught 2,687 passes, which was the most ever (thanks to a 17-game season) but still a bit south of per-game numbers from the 2015-16 peak. An average of 10.2 yards per TE reception was the lowest yet, so even with improved volume relative to the previous few years, the positional average of 50.4 receiving yards per game was the third worst in the past 15 seasons (ahead only 48.7 ypg in 2022 and 2010).

For fantasy purposes it was a much different story, especially in PPR leagues. The lack of touchdowns and yards per catch didn't matter nearly as much as the fact that more targets were concentrated in fewer hands. Seven tight ends topped 100 targets, with four others reaching 90 and three others in the 80s. The 2021 and 2016 campaigns each had slightly more TEs hit the 80-target threshold, but otherwise we hadn't seen as many tight ends hit any of those milestones (80/90/100 targets) since the infamous Gary Barnidge / Jordan Reed season in 2015.

Evan Engram, David Njoku and T.J. Hockenson all had career years in 2023 in their mid-to-late 20s, with the position further boosted by young breakout players (Trey McBride, Jake Ferguson) and an unusually productive rookie class (in addition to LaPorta's excellence, Dalton Kincaid caught 73 passes and Green Bay's Luke Musgrave and Tucker Kraft alternated stretches of streaming relevance).

2024 ADP reflects the newfound depth, with eight tight ends typically drafted Top 75 and three others often going before pick No. 100. Relative to previous years, drafters seem to have higher expectations for the low-end TE1s and fewer breakout candidates with legitimate upside in the later rounds. Gone are the days of 'Draft one TE early, or two late'. Drafters that miss out on LaPorta and Travis Kelce are much more likely to grab McBride, Ferguson, Kyle Pitts, etc., rather than waiting until the double-digit rounds to scoop a couple of low-probability breakout candidates and hope one hits.

In terms of fantasy starters, the position looks the deepest it's been in years. But if we're talking about fantasy benches, or the league as a whole... Well, not so much. Projections, rankings and ADP data all seem to be in agreement that the targets and production are likely to be highly concentrated among the top 10 or so players again.

If it plays out that way this season, picking the wrong starting TE will be more damaging than it was in past years. In addition to using an earlier pick than usual to draft our starting TE, we're now facing opponents that largely have avoided the same problem and are getting 10-15 PPR points per week from the position while we scrape for 7-8 on waivers.

In shallow/medium-depth leagues where it's not too challenging to amass strong RB and WR groups, it can even make sense to take two shots at guys with TE1 ADPs, perhaps drafting a combination like Travis Kelce + David Njoku or Kyle Pitts + Jake Ferguson. This offers protection against disaster scenarios while also providing two shots at landing one of the position's studs for 2024.

Final Words/Thoughts

For fantasy football, positional trends matter more than the league-wide scoring environment, insofar as the two things are unconnected. A season that's lower/higher-scoring than expected shouldn't matter much for fantasy if the gains (or losses) are distributed more or less evenly among positions.

Much of what's discussed above hints at a high likelihood of increased scoring relative to 2022-23, and perhaps even a full return to the pre-2022 norm of around 23 points per team game. The NFL certainly hopes so, installing a kickoff system that will move the matter along even if offensive efficiency only improves marginally.

There is, of course, a very real chance that the improvements in offensive efficiency are more than marginal. The past two seasons saw an interesting combination of increasingly complex defensive coverages and higher-than-usual rates of backup QBs making starts. There may have been a positive feedback effect, whereby the scrub QBs had a tougher time than the starters they replaced when it came to handling complex/disguised coverages (or were too willing to take low-reward, easy completions against two-high looks).

Either way, better injury luck at the QB position could go a long way, especially if combined with strong returns from the 2023 and 2024 draft classes at the position (which includes five top-five picks that will be Week 1 starters, plus Drake Maye likely joining them at some point this year). It's certainly a deep group of QBs in terms of fantasy intrigue, and the same can be said at the other onesie position, tight end, where a slew of players gained ground on long-time-alpha Travis Kelce last year.

The positions where we need multiple starters, by contrast, look to be more top-heavy than in the past (or in the case of running backs maybe just lighter in the middle and at the bottom). More points and better QB play might have an impact, but we're unlikely to see an immediate and drastic reversal of the trends that have funneled more of the valuable touches toward Alpha WR1s while taking looks away from the second/third/fourth-tier RBs.

When it comes to winning in fantasy football, knowledge and understanding of these big-picture themes is probably only 5 percent of the battle. Predicting the exceptions is what's really important, and for that you'll need your own ingenuity, some good luck and a bit of assistance here and there from RotoWire.